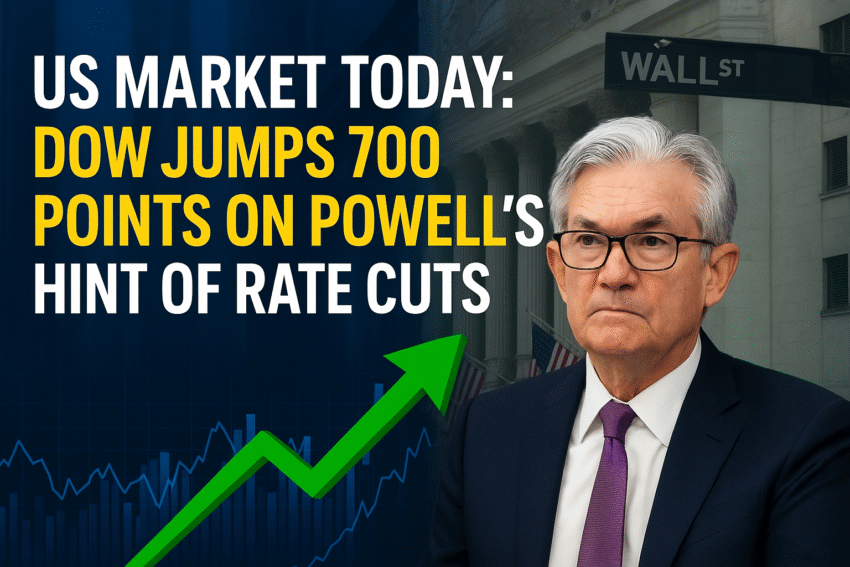

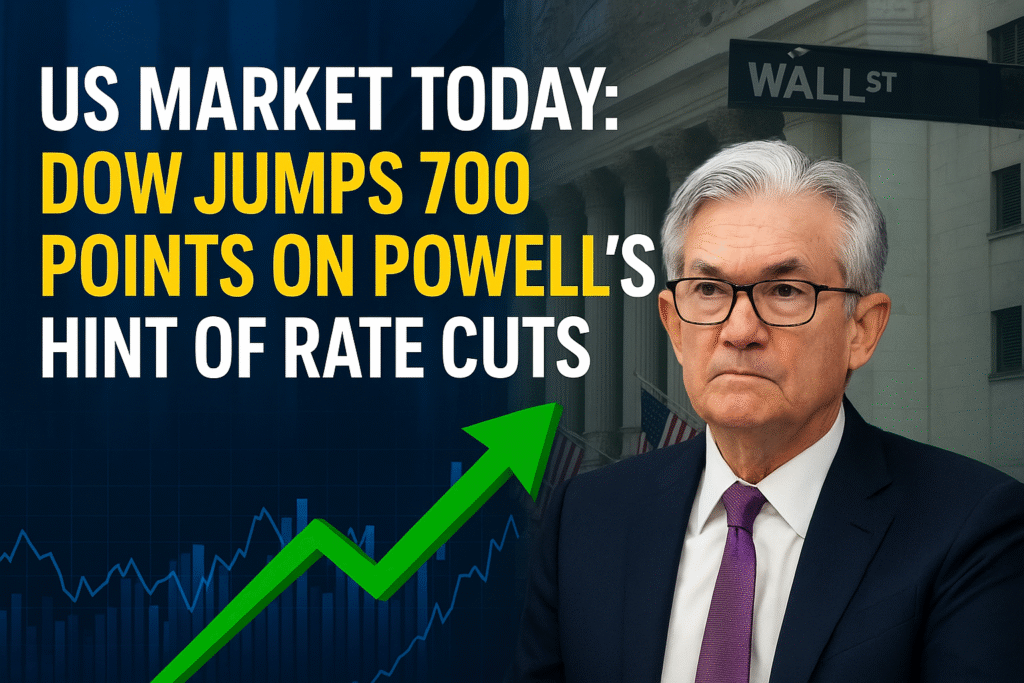

US Market Today: Wall Street Surges as Dow Jumps 700 Points on Powell’s Hint of Rate Cuts; Global Markets Track Gains

In a major boost to investor sentiment, US market today witnessed a powerful rally, with the Dow Jones Industrial Average soaring over 700 points after Federal Reserve Chair Jerome Powell hinted at possible interest rate cuts. The news ignited optimism across Wall Street and set a positive tone for global markets.

Powell’s Dovish Tone Sparks Rally

During his address, Powell acknowledged signs of cooling inflation and emphasized the Fed’s readiness to adjust monetary policy to support growth. While he did not directly announce rate cuts, his comments were widely interpreted by investors as a signal of an easing cycle ahead.

The market reaction was immediate, with investors piling into equities, particularly in interest-sensitive sectors such as banking, real estate, and technology.

Dow, S&P 500, Nasdaq Post Big Gains

The Dow surged by 700 points, its largest one-day gain in months, while the S&P 500 climbed nearly 3% and the Nasdaq rallied more than 2.5%.

- Banking stocks rose as lower rates typically reduce funding costs.

- Tech stocks gained sharply on expectations of cheaper capital.

- Consumer discretionary shares also surged, reflecting stronger optimism about demand.

Global Markets Mirror US Optimism

The US market today rally extended its influence across the globe.

- European stocks opened higher, with the FTSE and DAX gaining over 1%.

- Asian markets tracked Wall Street overnight gains, with Japan’s Nikkei and India’s Sensex posting strong advances.

- Emerging markets saw inflows, as investors grew more confident about global liquidity easing.

Treasury Yields and Dollar Decline

As equity markets rallied, US Treasury yields fell sharply, reflecting investor bets that the Fed may begin cutting rates sooner than expected. The US dollar weakened against major currencies, boosting commodities such as gold and crude oil.

Analysts’ Take on US Market Today

Market experts noted that Powell’s comments marked a shift from a purely hawkish stance to a more balanced, data-dependent outlook.

- “The US market today rally shows how sensitive investors are to Fed signals,” said a senior economist.

- Others warned that while rate cuts could support growth, premature easing may reignite inflationary pressures.

What It Means for Investors

The sharp move in the US market today suggests traders are now pricing in at least two rate cuts in the upcoming year. For retail and institutional investors, this could mean:

- Stronger equity performance in cyclical and growth sectors.

- Bond market rally, with yields expected to trend lower.

- Weaker dollar, boosting global trade and emerging market performance.

Global Implications

If the Fed proceeds with rate cuts, it could reshape global financial flows. Cheaper capital would benefit emerging economies, while a softer dollar may help countries reliant on exports. However, inflationary risks remain a concern, especially in energy and food markets.